What do you understand by the term Economics?

Economics is the science of scarcity.Studying how we manage our resources in the production of goods and services to achieve collective betterment. In economics, we optimize our resources for the production of goods and services.

Often confused: Economics or finance?

Economics is often confused with finance as money is a resource that can be used to quantify all other resources. While finance only focuses on wealth management, economics accounts for factors such as production and supply.

BUSINESS & ECONOMICS

Any business’ penultimate aim is to maximize shareholders’ returns and create value. You as a business enthusiast should know how the background instruments of an economy work to optimize operations and create maximum value by the most efficient use of resources.

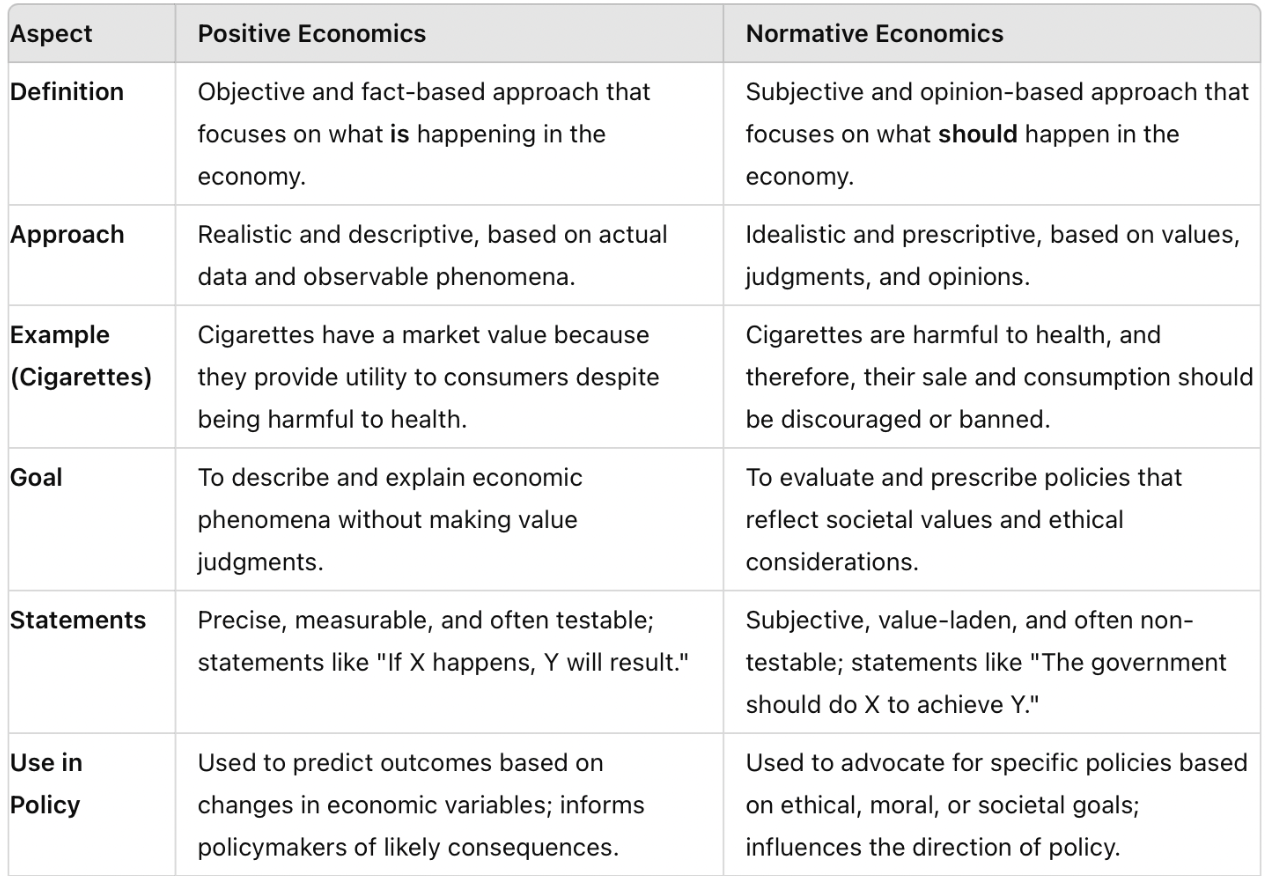

WHAT IS VS WHAT SHOULD BE

The Concept of a Market in Economics

A market, in its most fundamental sense, is a place where buyers and sellers come together to exchange goods, services, or resources. While traditionally, markets were physical locations like bazaars, shopping centers, or stock exchanges, the concept in economics is much broader and more abstract.

The Nature of Markets in Economics

In modern economics, a market is not necessarily a physical space. It is better understood as the entire system of interactions between buyers and sellers where goods, services, or resources are exchanged. This includes all the processes of pricing, supply, and demand that take place within a particular market. These interactions determine the value of goods and services, and influence the allocation of resources in an economy.

- Regulated markets are governed by rules and regulations set by governments or other authorities to ensure fairness, prevent monopolies, protect consumers, and promote economic stability. Examples include stock markets, where financial transactions are closely monitored, or the labor market, which may be subject to minimum wage laws and employment standards.

- Unregulated markets operate with little to no oversight. Transactions are driven solely by supply and demand without external intervention. While unregulated markets can foster innovation and efficiency, they can also lead to market failures, exploitation, or inequity, as seen in some informal or black markets.

Adam Smith’s Invisible Hand

The invisible hand is a metaphor that illustrates how, in a free market economy, individuals acting in their own self-interest unintentionally contribute to the overall well-being of society. This concept suggests that when people pursue their personal goals, such as profit or personal satisfaction, they inadvertently support a system of mutual interdependence. In this system, the actions of individuals help allocate resources efficiently, promote innovation, reduce price and encourage competition. As a result, the collective actions of these self-interested individuals lead to economic growth, stability, and the provision of goods and services that benefit society as a whole.

The invisible hand represents the idea that free markets, when left to operate without excessive interference, have a natural ability to self-regulate and harmonize individual pursuits with the broader public interest. This all has a fancy jargon called laissez faire.

Microeconomics deals with the behavior of individual economic units-consumers, firms, workers and investors- as well as the markets consisting of them. This approach is called bottom-up as we first loom at individuals who then add up to create the larger picture.

Macroeconomics deals in aggregate economic variables such as growth rate of national output, interest rates, unemployment, and inflation. It is called a top down approach as we start by looking at the large picture (the entire economies).

MACROECONOMICS

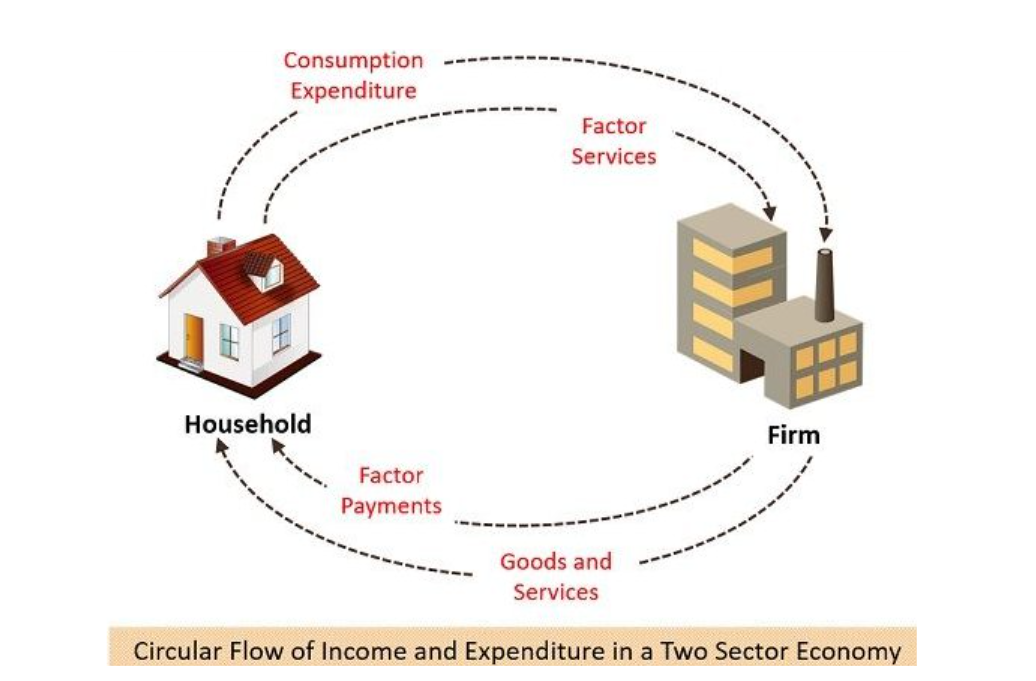

The circular flow of income

The circular flow of income is a circular flow model which shows how different agents of an economy such as goods, money and services interact, breaking things down in a very simplified manner.

There are many ways to look into the circular flow of income:

- Two sector model

- Three sector model

- Four sector model

- Five sector model

The Two Sector Model consists of firms and household sectors. Firms are the producers of goods and services in an economy. They do so by using factors of production provided by the household sector which in return receive income from the firms in terms of rent, wages, interest and profits. Firms earn revenue from selling their goods and services to the households.

The four factors of production are land, labour, capital and entrepreneurship. These four factors are required by the firms for production and are supplied by the household sector.

The Three Sector Model consists of firms, households and the governments. In such a model the government can act as a consumer and a producer. In India PSUs act as producers, much like private firms. However they are owned and operated by the government. Here, the government earns by collecting taxes from firms and households. These can be income tax, property tax, corporate tax etc. It then uses the tax revenue to spend on welfare projects, subsidies, infrastructure projects, thus injecting money back into the economy.

The Four Sector Model includes foreign imports and exports along with the previous sectors. In such a model the money is leaked out of the economy in the form of purchases made on foreign imports, instead of domestic goods. Corresponding to this leakage that is import, there can be an injection based on the possibility of exporting domestic goods to foreign markets.

The Five Sector Model includes banks and financial sectors additionally. Money is deposited into banks as savings. There will be decline in the sale of goods of the value of the money deposited as savings, hence a leakage. An injection is made in the form of investments to firms to compensate this leakage by savings.

Gross Domestic Product

The circular flow of income is used to estimate key economic indicators such as gross domestic product, national income, and aggregate demand.

GDP is the total income of an economy. It is the market value of all final goods and services produced within the domestic boundaries of a country in a specified period of time.

GDP(Y) = Consumption (C)+ Investment (I) + Government Expenditure (G) + Net Export (X-M)

However, GDP measures only the economic activity within a countries borders, failing to account for income earned by residents from abroad or income earned within the country by foreign entities. Gross National Product (GNP) measures some of the limitations of GDP, particularly in relation to income from abroad.

GNP = GDP +Net factor income earned from abroad

Inflation

It is another key economic concept that directly impacts measures like GDP, GNP and overall economic well being. Inflation refers to the gradual increase in price leels of goods and services in an economy over a period of time. As inflation rises each unit of currency buys fewer goods, effectively decreasing the purchasing power of money.

Shrinkflation

Shrinkflation is the practice of reducing the size, quantity, or quality of a product while maintaining the same price. This allows companies to cope with rising production costs without visibly increasing prices, though consumers end up paying more per unit of the product.

Hyperinflation

Hyperinflation is an extremely high and typically accelerating rate of inflation, often exceeding 50% per month. It is a rare and extreme scenario where prices increase rapidly and uncontrollably, leading to a collapse in a country’s currency value.Zimbabwe experienced one of the most extreme cases of hyperinflation in the 2000s, with inflation rates reaching billions of percent. The Zimbabwean dollar became so devalued that it was eventually abandoned in favor of foreign currencies.

MICROECONOMICS

Understanding Demand and Supply in the Commodity Market

Demand and Supply Basics

Imagine you're at a farmers' market. The price of apples will depend on how many people want to buy them (demand) and how many apples are available (supply). When demand increases, prices rise. If supply increases, prices drop. This balance is at the heart of every market.

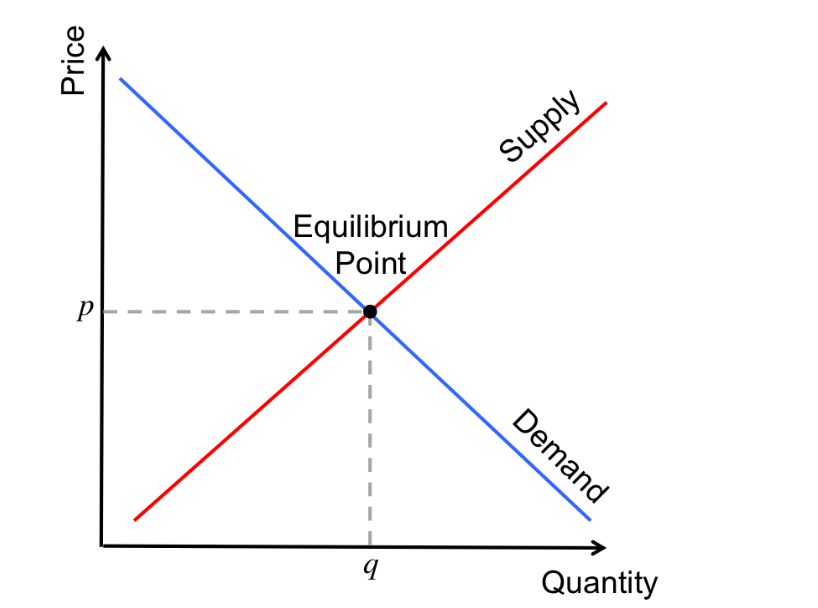

Supply and Demand Curve

Elasticity:

Elasticity measures how much the quantity demanded or supplied responds to price changes.

- Elastic Demand: Luxury goods, like designer handbags, often see significant drops in demand if prices rise even a little.

- Inelastic Demand: Think of essential goods like gasoline. Even with price increases, people still need to buy it.

Elasticity Formula:

Elasticity of Supply = % change in quantity supplied / % change in price

Economic Surplus: Who Benefits?

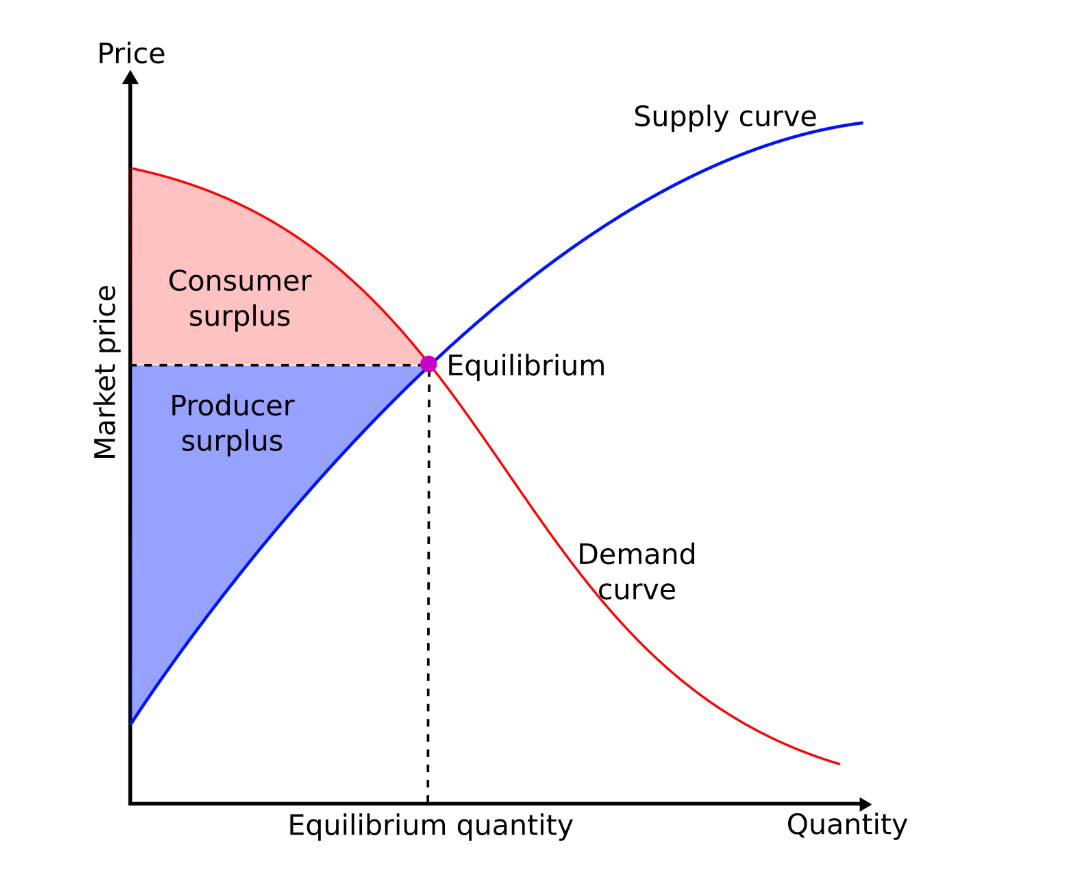

Economic surplus is the difference between what consumers are willing to pay and what they actually pay (consumer surplus) and the difference between what sellers receive and their minimum acceptable price (producer surplus). Imagine a graph where consumer surplus is the area above the price level and below the demand curve, while producer surplus is below the price and above the supply curve.

In a well-functioning market, both consumers and producers benefit, maximizing total economic surplus.

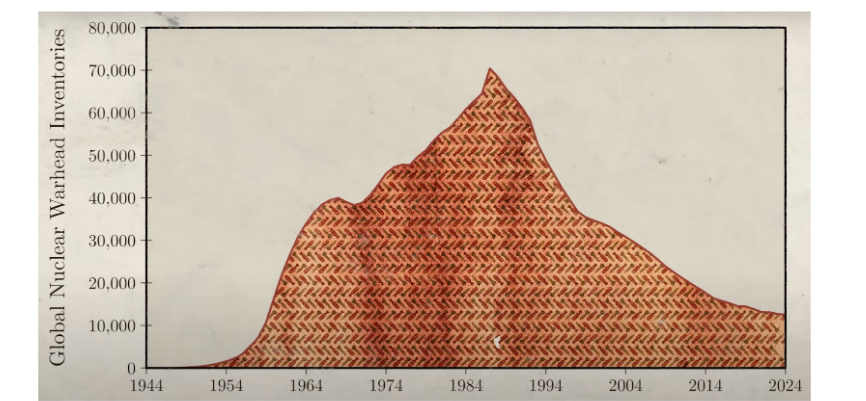

How Economics Guided Resource Allocation for the Greater Good During Wartime

During the Cold War, the USA and Russia recognized that they were depleting their limited resources by maintaining vast arsenals of warheads. To address this, economists from both nations devised a strategic approach based on game theory. The strategy involved one country reducing its nuclear arsenal at the end of each year, with the expectation that the other country would reciprocate. If both countries mirrored each other's actions, the cycle would continue, leading to significant reductions in nuclear stockpiles. This iterative process of mutual reductions ultimately saved both nations billions of dollars, allowing them to reallocate resources more productively.